Institutional Services

Foundation and Endowment Services

Most every foundation or endowment board is composed of a diverse group of individuals who bring a variety of skill sets to the underlying organization. These individuals typically volunteer their time and resources out of the goodness of their heart to benefit a cause they believe in yet often unknowingly expose themselves to personal liability for the management of funds that have been entrusted to them. As investment fiduciaries with over 5O years of combined investment experience, we are uniquely qualified to mitigate your exposure in the oversight of these entrusted funds.

Our services include:

- Investment Policy Statement Review, Design and Consulting

- Investment Consulting including Manager Search and Selection

- ESG and Socially Responsible Investment Strategies

- Risk Analysis

- Interest Rate Sensitivity Analysis

- Market Shock Analysis

- Efficient Frontier Modeling

- Cash Flow Analysis

- Asset Allocation Consulting

- RFP Management

- Donor Advised Funds

Spend more time pursuing the mission of your organization by partnering with Alpha Financial Partners. We will help maximize the dollars entrusted to you and mitigate the liability on the people who passionately give of themselves to serve your worthy mission.

For more details, contact:

Aaron Ammerman

aammerman@alphaky.com

Alpha Financial Partners

710 E. Main Street; Suite 110

Lexington, KY. 40502

(859)785-2663

The current tenuous state of many public pension systems in the United States is a reminder that many pension consultants have been offering the wrong guidance. At best, these consultants have offered advice without first fully examining and understanding the complex variables related to the plan itself. At worst, many are politically or ideologically motivated and manipulate data to support their recommendations.

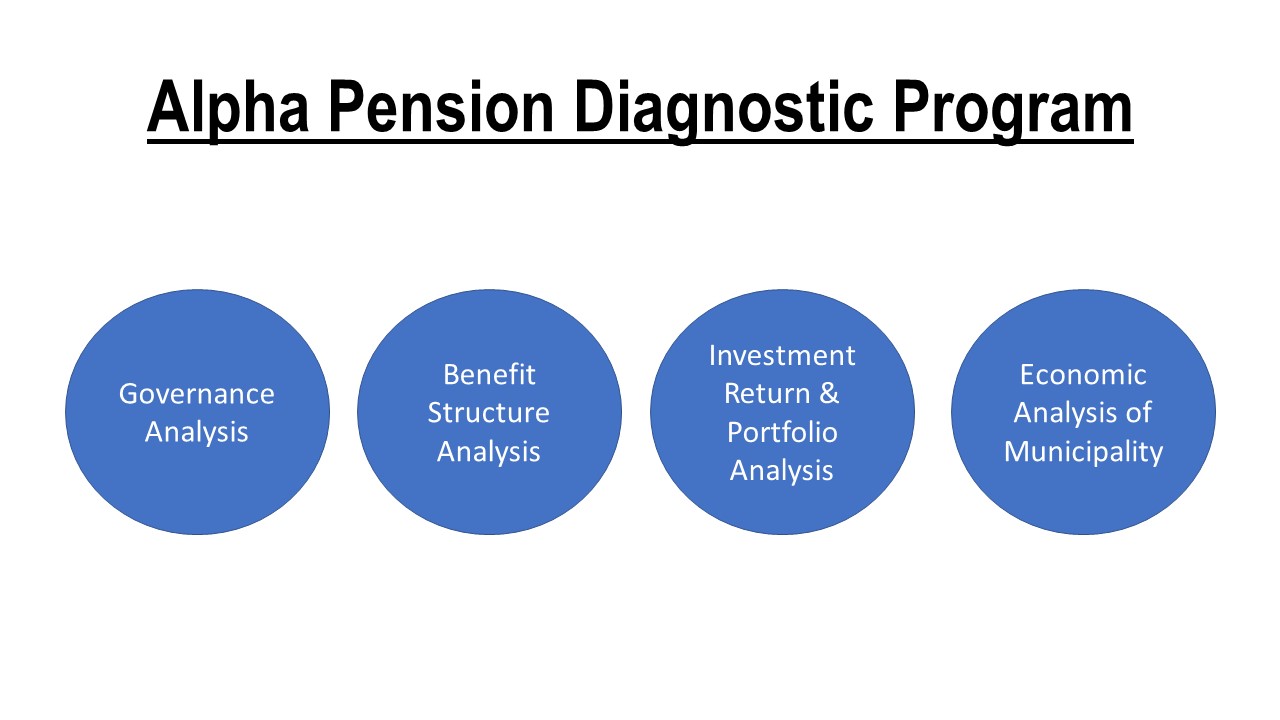

For these reasons, we have designed the Alpha Pension Diagnostic Program. Our four tiered objective analysis will uncover the true status of a pension system leading us to then construct a plan for the way forward.

The Alpha Pension Diagnostic Program focuses on four key areas:

Governance Analysis:

- Is there a structure in place that gives all stakeholders a voice?

- How can the relationship between stakeholders improve?

- Are meetings and data transparent and documented?

- How often is the board required to change actuarial consultants?

- Do strict and enforceable conflict of interest policies exist?

- Are there individuals on the board with investment experience?

- How often is there communication with the investment manager?

Benefit Structure Analysis:

- How many employees are currently paying into the pension fund?

- How many retirees are receiving benefits?

- Have benefits, including COLAs, increased or decreased over the last 20 years?

- What is the targeted income replacement for an employee at retirement?

- What is the trajectory for the ARC required by the employer?

- When was the last time key inputs such as payroll growth rates, portfolio assumed rates of return, and benefit factors have been reviewed or changed?

- Is the current benefit structure adequate to attract the workforce of the future?

Investment and Portfolio Analysis:

- Is the Assumed Rate of Return achievable?

- Is the asset allocation appropriate to achieve the stated Assumed Rate of Return?

- What is the total cost for investment management including consulting, advisory and operating expenses?

- Does the board have an understanding of the investments?

- Has the auditor for the plan raised any concerns about the valuations of the investments?

Economic Analysis of Municipality:

- What are the demographics of the citizens who live within the municipality?

- What are the demographics of the municipality's workforce?

- What is the current tax structure of the municipality and how has it evolved?

- What are the trends within the municipal budget?

Honoring retirement benefit commitments made to employees, protecting the viability of the retirement system and providing a retirement benefit that meets the expectations of a modern workforce are all goals that can and should be achieved.

There is a better way: Analysis. Truth. Vision.

Private Pension Consulting

We bring to bear the same skills and resources in approaching the private pension marketplace as we do the public, including risk transfer/annuity buy–outs, Liability Driven Investment (LDlC expertise, and plan termination annuity brokerage.